|

The Bretton Woods Agreement Opened the Door

|

|||||||||

|

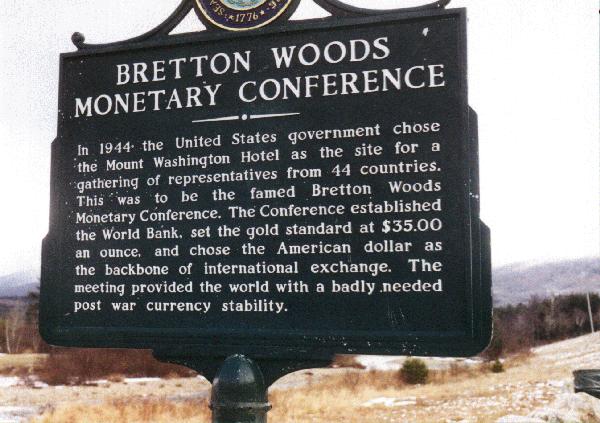

The 44 member countries who attended the Bretton Woods Conference, who would eventually ratify the entire agreement, were all allies of the U.S. during World War II.

Under the agreement, due to it's strength and stability at the time, the U.S. dollar replaced the British pound sterling which had previously been recognized and accepted as the world's reserve currency prior to the creation and implementation of the financial policies and structure that the Bretton Woods Agreement established.

The reason the change was made, is because, at the time, U.S. currency had the greatest purchasing power. In addition, the U.S. was the only country with the ability to print dollars, and when the agreement was adopted, U.S. currency was still backed and supported by a gold standard.

Although the U.S. does still "print dollars", the other factors that established it as being "strongest and most stable" wouldn't last long.

The instability is quite prevalent and obvious today.

Prior to the elimination of the gold standard by the U.S. government, The Bretton Woods Agreement essentially eliminated the gold standard to a degree, because under the agreement, the value of the U.S. dollar and it's relation to gold was set as the gauge for the value of ALL the allied countries currencies.

Although the U.S. monetary system was strong at the time and was supported by a gold standard, at the time the Bretton Woods Agreement was adopted, the U.S. currency was still only "partially backed" by gold.

Stay with me here, because this is VERY IMPORTANT to understand.

I say partially backed because, what I personally view as another very ingenious yet sinister policy was already in place and fully functioning at the time. It was a policy that was established and used for many decades prior to the implementation of the Bretton Woods Agreement.

That policy is known as the fractional reserve banking system.

Without going into a long history of facts, in essence, the fractional reserve system eliminated, or at the least, dramatically limited the need to store and maintain a fixed amount of gold equal to the number and value of notes that were printed, distributed and held by gold/silver investors and owners.

Due to how a fractional reserve system operates, any country that uses and adopts it (all countries have) are essentially depending on a system that operates based on debt not liquidity.

A Gold Standard Coupled with a Fractional Reserve Banking System is NOT a System That's Fully Backed By Gold

With a "true" gold standard, an equal amount of gold reserves exists for every "paper dollar" printed and put into circulation. NOT the case in a fractional reserve system. Under the fractional reserve system, only a fraction of the value of an amount of gold is required to be held in reserve at the banks.

It's what creates and enables a system of credit and debt to function...temporarily at least.

During the 22 day Bretton Woods Conference, attendees outlined rules and regulations for what would soon become an international monetary system. It did this by tying the western world's monetary systems together in a sense. It established a set of rules for commercial and financial relations between the world’s most important industrial nations.

In essence, the U.S. dollar served as the barometer which determined the value of the entire western worlds currencies.

Like the Bretton Woods Agreement, the period in which the fractional reserve system was implemented, proved to be a pivotal point in history too. The fact is, that system gave birth and opened the door to what we have today...an out of control, corrupt, illegal, cunning and manipulated monetary system, overseen and governed by a small, but VERY powerful, handful of "VERY wealthy self serving bankers" who, since the "supposed" ratification of the Federal Reserve Act in 1913, have progressively used their power to advance their sinister agenda and effectively have fleeced America and many other countries of their wealth.

This plan has nearly wiped out what was once known as the middle class.

What's more, they continue to use that money and acquired power to carry out what many call an "ongoing long term sinister agenda" that's far too involved and complex to cover here.

Those "ingenious yet sinister plans" continue to this day. Through understanding how everything ties together, it's quite easy to see how the Fed is "legally raping" America (and much of the world) of, not only it's wealth, but the liberty and freedoms guaranteed to us by our forefathers and documented as "Real Law" through the Constitution of the United States of America.

What's truly amazing to me, is that although our monetary and taxing system is COMPLETELY and TOTALLY Illegal based on what the U.S. Constitution clearly states to be a "legal monetary and taxing system", the overseers of this "illegally implemented monetary system" are "legally protected" by government, via commercial law. Under this and for MANY years have received a consistent flow of HUGE amounts of cash via a fiat monetary system and an out of control taxing system, kept alive by nothing more than the "labor of the people", combined with a "collective belief in" a fiat currency "perceived to have value" when in FACT, paper money has ZERO value, and in actuality never will unless and until the system is changed.

What is Fiat Currency?

In essence a fiat currency is "paper money" that has no value with the exception of the value of the paper it's printed on. The ONLY thing that guarantees the "exchange value" of "paper fiat money" that the entire global population depends on today, is a government's promise to pay.

The same applies to ALL countries today. Every country has a fiat currency, backed by nothing more than "a promise", because currently, there is no country in the world that adheres to a gold standard. As such, every country only has a governments "Promise to Pay" as security that their "fiat currency" (which in reality has no real intrinsic value) will continue to hold some form of "perceived" exchange value.

That's the ONLY thing keeps the belief, perception and the world's monetary system alive. A promise.

The promise and the ability to exchange "paper dollars for goods and services is the ONLY thing that keeps the current global monetary system alive and functioning, although it's "function" is causing a lot of havoc and unrest globally.

If the "governments promise" continues, the belief in the system and the perception that "paper dollars" have value will continue.

Here's the thing about depending on a governments promise for your survival and well being...

Throughout history, promises have been and will continue to be "broken", ESPECIALLY by governments who's laws and policies are polluted with the self serving interests of a few VERY wealthy bankers. The entire system is tainted with corruption.

As one of our founding fathers clearly stated, when you give a private group of bankers control and the ability to manipulate the world's money supply, those who HAVE the money will RUN the country.

Since these policies began in 1913, these "bankers" already possess most of the world's money, as well as the political power and influence to ensure that their "self directed interests" are carried out..."legally" as they say.

Point being, today's monetary system is held together by nothing more than a "governments promise" and the global population's "belief in" that promise.

|

The continued "belief" in this "so called promise" is important. It is because, there is nothing (no store of value) that holds "intrinsic value" to back, support and guarantee the "fiat papers" value, other than the governments "promise."

Should the promise ever go away, money would lose it's exchange value, the "public belief" in money as we know it would cease to exist and the fiat monetary system that we use and depend on today would come crashing down and be revealed for the house of cards that it is.

The 2008 Housing and Financial Crisis Brought on by Greed, Corruption and Shady Tactics Nearly Leveled This "House of Cards"

The housing crisis of 2008 provided the world with tangible proof of just how real and dangerous this threat is. Although it happened in the U.S., due to HOW the entire world's financial system is tied together since implementation of the Bretton Woods Agreement, the global financial market was (and is still being) impacted and nearly brought to it's knees.

The bankers transferred MORE wealth and power and the government bailed the banking system out, essentially playing the role of accessories to THEFT by contributing to the "illegality" of the fleecing that took place.

What does all that have to do with the Bretton Woods Conference or the Bretton Woods Agreement?

Although a thing of the past, the effects of the Bretton Woods System are still very much felt today. At the time it was adopted, it established a fixed exchange rate of foreign currency that was linked to the U.S. dollar. In other words, other countries pegged the value of their currencies to the U.S. dollar.

As a result of the agreement, the International Monetary Fund (IMF), as well as the International Bank for Reconstruction and Development, (a part of today's World Bank) were created.

They are institutions that were intended to oversee, monitor and when necessary, loan money to participating countries to ensure that financial equilibrium among the countries was maintained, the system worked as designed and that the central banks within each of those countries adhered to the agreement.

For a while, the Bretton Woods System did "seem to work" as well as it could, although, due to a number of unforeseen problems, one of which was created by fractional reserve banking, would soon change and the Bretton Woods Agreement would come to an end.

How the Bretton Woods Agreement and the Gold Standard Met Their Demise:

At the time when the Bretton Woods Agreement was drafted, the U.S. dollar was the only currency strong enough to meet the rising demands for international currency transactions.

Because the U.S. dollar was backed by gold at the time when the Bretton Woods Agreement was ratified, the fixed relationship of the dollar to gold (set at $35 an ounce at the time), and the commitment (the "promise") of the U.S. government to convert dollars into gold at that fixed price, made the "paper dollar" of that day, almost as good as gold.

In fact, for bankers of the day, the dollar was MUCH better, far more flexible and CERTAINLY more beneficial to them than gold because, due to the existence of the fractional reserve system, "paper money" earned them (and still earns them to this day) HUGE amounts of interest.

Because the U.S. adhered to a gold standard then, over time the U.S dollar gained momentum and became the international reserve currency when Bretton Woods was adopted. It was done that way in part because, at the time, the American dollar was still directly linked to the price of gold.

That wouldn't last long and would soon become a thing of the past also.

The U.S. Government Abandons the Gold Standard in 1973:

Let's look at what happened to the U.S.'s "commitment or "promise" (whichever you prefer to call it) regarding the fixed price of gold that it "promised" would be fixed to maintain and guarantee the value of "paper dollars."

In 1971, the U.S. was suffering from massive inflation and recession. We won't cover all the hows and whys here, but the suffering was partly a result of the dollar's role as a global currency.

Because of the fractional reserve system, more money was "out in circulation" than the governments assets or "promise" could fulfill if those who held these "notes" (gold and silver certificates) started showing up to exchange them for the gold that they represented.

The government and the entire monetary system was in trouble.

In response, the first thing President Nixon did, was started to deflate the dollar's value in gold. First, the dollar was repriced to 1/38 of an ounce of gold. Later it was lowered further to 1/42 of an ounce.

The "governments promise" changed and needless to say, the plan backfired too...big time.

Rather than "fix things", the devaluing of the currency triggered fear in the people and a waning "belief" in the monetary system itself. With all afraid that their money would lose more value, their backfired plan created a run on the U.S. gold reserves at Fort Knox as people showed up to the banks in droves to redeem their quickly devaluing dollars for the gold that was "supposed to be there" to back them.

As it often does, history was repeating itself. Just as a run on the banks caused the Great Depression in the 1930's, the gold that was "supposed to back" the 70's dollar wasn't there either.

A Bad Situation, a Plan Gone Bad and the Growing Fear of the Public Led to the Elimination of a Gold Standard.

The U.S. found itself in a HUGE mess and so, in 1973, to keep another depression from happening, Nixon severed the link between the value of gold and the dollar altogether. Without anything in place to control it's price, gold quickly shot up to $120 per ounce, the fixed rate of the U.S. dollar to gold ceased and the Bretton Woods System as it was known, was over.

Although gold was the "tangible asset" that was "supposed to" support and give U.S. paper currency it's strength and "value", due to an "over printed amount" of "paper money", the United States was forced to terminate the gold standard which brought an end to the Bretton Woods system.

Why Would the U.S. Terminate the Gold Standard?

Because the redemption value (represented by gold and silver reserves) for the "paper money" didn't exist. When there is more "paper" in circulation than there is gold (something of Real Value) to back it, should everyone (or A LOT of people) want to exchange their "paper" for gold all at the same time, since that gold isn't really there, the exchange of paper for gold couldn't be carried out and entire financial system would collapse.

They would have discovered that their "paper money" was nothing more than that...paper. Worthless paper at that, without the "promise."

That's precisely what the U.S. government feared and why in 1973, the U.S. abandoned the gold standard.

What "nearly happened" in the 70's is precisely what happened and led to the Great Depression of 1933. Due to MANY factors, the "belief" in the monetary system began to wane. The public became uneasy and feared they would lose the money they had deposited in and entrusted to banks. There was a run on the banks and not sufficient capital (gold and silver) existed to support the redemption demand for the "paper money" being brought to the banks to exchange.

Put simply, there was a LOT MORE "paper money" in circulation than there was gold and silver to redeem and satisfy the "supposed guaranteed value" of those "pieces of paper."

Essentially the monetary system crashed, people lost their money and the U.S. and many other countries around the world entered into and endured what's described as the longest, deepest, and most widespread 15 year depression the 20th century had ever seen.

The Actions of the 70"s Led to The Avoidance of ANOTHER Great Depression

When the same situation began to take shape in the early 70's, to eliminate the possibility of another depression, in 1973, Richard Nixon declared an end to the gold standard (aka the Nixon shock) which also led to the demise of the Bretton Woods Agreement.

In essence, that situation resulted in the United States dollar (now turned fiat currency with ZERO backing) replacing gold as the world's reserve currency.

Uh oh. BIG mistake and much cost for the free world. No doubt about that. Could it be that the Bretton Woods Agreement was a carefully thought out ingenious plan that, over time would open the gates for a transference of wealth from the many in the free world to the few in the elite banking world who only allowed those in the free world to "think and believe" they were free?

What if it was this same monetary system which is what kept unaware masses from ever becoming "truly free?"

If you've read any of the other articles listed on the right side bar of this page, depending on and handing power and control of your entire financial system over to a private banking cartel, give them the power to oversee, control and manipulate this fiat monetary system whose foundation is built on a system of debt and those who make the decisions benefit and make HUGE sums with it?

I'd say BIG MISTAKE basing the security and growth of your currency on an "Illusionary and Self Serving" fiat monetary system.

It's a system that opened the door to MUCH secretiveness, deceit, corruption and the ongoing transference of wealth that has been ongoing since 1913 and is STILL, not only quite prevalent, but clearly evident if you take an uncommonly deep look at how our monetary and taxing system works today.

Here's what's sinister about what happened to cause the depression and the events in the 70's...in my mind. The money circulating was printed with virtually no backing. You could say, it came out of thin air and vanished back into thin air when fear kicked in, "public belief" in the system waned, which led to a run on the banks only to discover that the (Real store of value - gold and silver) that was "supposed to be there" to guarantee and redeem upon demand the value of the notes (gold and silver certificates at that time) for the gold owned by the people and "supposedly held" by the bank, wasn't really there at all.

Not much has changed today, with the exception of the entire fiat monetary system coming to an ugly head and teetering on the brink of collapse.

The fractional reserve system is still alive and well. It was actually created and used by goldsmiths MANY years before the Bretton Woods Agreement, when they realized that, although many people used their service to store their gold, only a small percentage would come at a time to redeem their receipts for the gold they stored.

The goldsmith's realized they could saw an opportunity to earn A LOT of money because they could issue MANY receipts for a single deposit of gold. That's when and how the fractional reserve system began.

Today's banks still adhere to and utilize the fractional reserve system, although the gold standard has long since been abandoned and a gold backed currency no longer exists.

Since current day "law" enables banks to "get by" with only holding a "fraction of deposited monies in reserve", they are able to make MANY loans on a single deposit, and are only required to hold a "fraction" of each deposit in it's vaults to satisfy the "legally set percentage" of reserve that today's banking laws require.

Although today's "paper money" is no longer backed by ANYTHING, the fractional reserve system is still utilized and calculated based on "paper money" deposits of various forms, that in reality have ZERO value.

Because banks are only required by law to keep a "fraction of deposits in reserve" they were (and still are) able to make SEVERAL loans on a single deposit and earn interest from those several "loans" all at once.

Consider that. You make a single deposit in a bank and MANY loans equaling far greater value than the initial deposit become possible, all of which are made possible via your "single" deposit.

The Bretton Woods System Essentially Eliminated the Gold Standard:

Even though it was said that U.S. currency was backed by "gold", when the Bretton Woods System was implemented, because the fractional reserve system was in place, it wasn't truly or fully backed, because in a fractional reserve system, only a portion (a fraction) of the value of bearer notes being printed and circulated were required to have "gold backing." (See Fractional Reserve Banking System)

Prior to the implementation of a fractional reserve banking system, the only Real Money that existed was precious metals...namely gold and silver.

Here's How The Bretton Woods Agreement Worked:

Under the Bretton Woods agreement, countries promised that the central banks within their countries would use the U.S. dollar as the gauge which determined the value and buying power of their dollars.

This was achieved by maintaining fixed exchange rates between their currencies and the dollar. How exactly would they do this? If their currency's value became too low relative to the dollar, they would buy up their own currency in foreign exchange markets. This would decrease the supply of their money in circulation, which would automatically raise the price. If the value of their currency became too high in relation to the U.S. dollar, they'd print more, increasing the supply which automatically lowered the value of their currency.

As long as the plan was followed, it worked and kept thing in balance. It did because of simple supply and demand. When supply of anything is high, the value is perceived as being lower. When the supply of money is high, it requires more dollars to buy goods and services. When money supplies are low, the perceived value is higher, requiring less dollars to trade for the very same goods and services.

Members of the Bretton Woods system also agreed to avoid any trade warfare, such as lowering their currencies strictly to increase trade. However, they could regulate their currencies if foreign direct investment began to stream into their countries in such a way to destabilize their economies. They could also adjust their currency values to rebuild after a war.

How the Bretton Woods Agreement Served as the Catalyst to Replace and Eliminate the Gold Standard:

Prior to Bretton Woods, the world had followed and adhered to the gold standard. This meant each country guaranteed that its paper currency would be and could be redeemed by its value in gold.

After Bretton Woods, each member agreed to redeem its currency for dollars, not gold.

Why dollars? Because, at the time the value of the U.S. dollar was backed and supported by gold. In addition, the U.S. held three-fourths of the world's supply of gold.

At the time when the Bretton Woods Agreement was signed, the U.S. dollar's value was established and set at 1/35 of an ounce of gold, so in a way the world was still on somewhat of a gold standard.

At the end of the Bretton Woods Agreement, the U.S. dollar had now become a substitute for gold since the gold standard had been abandoned.

This discrepancy in value, planted the seed for the collapse of the Bretton Woods system three decades later.

Why the Bretton Woods System Was Needed:

Until World War I, most countries were on the gold standard. However, they went off so they could print money on demand to "create" the currency needed to pay for their war costs. This printing of money, caused hyperinflation, as the supply of money increased, the demand was lowered. The value of money fell so dramatically that, in some cases, people literally needed a wheelbarrow full of cash just to buy a loaf of bread.

All went well until the Great Depression. After the 1929 stock market crash, investors switched to trading in currencies and commodities. This drove up the price of gold, resulting in people redeeming their dollars for gold. The Federal Reserve made things worse by defending the nation's gold reserve by raising interest rates. It's no wonder that, as World War II wound down, countries were ready to abandon the gold standard.

However, after the war, countries returned to the safety of the gold standard until the Bretton Woods agreement came into play.

The Bretton Woods system gave countries more flexibility than a strict adherence to the gold standard, but less volatility than no standard at all. A member country still retained the ability to alter its currency's value if needed to correct what is called a "fundamental disequilibrium" in its account balance.

The creation of the IMF and World Bank:

The IMF was created to oversee and enforce the Bretton Woods agreement.

The Bretton Woods system could not have been put into place without the IMF. That's because the IMF served as the overseer of the system and the world bank (then called institution that would bail out participating countries if their currency values got too low. They served as a global central bank that participating countries could borrow from in case they needed to adjust their currency's value, and didn't have the funds on hand to do so themselves. Otherwise, they would just slap on trade barriers or raise interest rates.

The Bretton Woods countries decided against giving the IMF the power of a global central bank, to print money as needed. Instead, they agreed to contribute to a fixed pool of national currencies and gold to be held by the IMF. Each member of the Bretton Woods system was then entitled to borrow what it needed, while staying within the limits of its contributions.

The World Bank, despite its name, was not the world's central bank. At the time the Bretton Woods agreement was created, the World Bank was set up to lend to the European countries devastated by World War II. Today, the purpose of the World Bank is to loan money to economic development projects in emerging market countries.

The Collapse of the Bretton Woods System led to the Worldfiat currency:

In 1971, the U.S. was suffering from massive inflation and recession. This was partly a result of the dollar's role as a global currency. In response, President Nixon started to deflate the dollar's value in gold. The dollar was repriced to 1/38 of an ounce of gold, then 1/42 of an ounce.

However, the plan backfired. It created a run on the U.S. gold reserves at Fort Knox as people redeemed their quickly devaluing dollars for gold. In 1973, to keep another depression from happening, Nixon unhooked the value of gold from the dollar altogether. Without price controls, gold quickly shot up to $120 per ounce in the free market. The Bretton Woods system was over.

Banks of the past are much different than today's banks. How they do business is different to. Initially banks were created to serve as storehouses for gold and silver. Banks were essentially storehouses created to provide safekeeping for an owners gold and silver reserves. The bank would charge the owner a fee for storage, and the owner would be given a receipt, showing how much metal he had on deposit.

Upon presenting that receipt to the bank, the amount of gold and silver stored there could be redeemed by the depositor by surrendering the receipt held which served as proof of ownership of the gold/silver owned by the receipt holder and stored by the bank.

Over time, due to the inconvenience of storing and trading the actual commodities, paper money was created. In essence, paper money (called "bearer notes" initially) replaced the "receipt" (proof of ownership of gold/silver) that was used prior. In order to make the trading of gold and silver currency for goods and services more convenient, bearer notes were printed, issued and circulated, which enabled it's holders the ability to directly exchange those notes for goods and services without actually having to carry and physically handle gold and silver.

The gold and silver remained in the bank and the new "paper money" represented receipt and proved ownership of whatever amount of gold and silver that was stored. Paper money was merely the medium of exchange used which reflected the REAL store of VALUE via the gold and/or silver that an individual deposited.

The acceptance of this system, gave the paper money (bearer notes) "perceived value", although in and of themselves, they had and still have no real value. They were merely a paper receipt that represented the amount and value of gold and silver that the bearers of these notes had stored in the bank.

Federal Reserve Notes today are the same. Although they are "supposed to represent" a "store of value", the reality is they HAVE no value whatsoever simply because they have NOTHING of value to back them.

The bottom line is this. When the Bretton Woods System was adopted, once the U.S. abandoned the gold standard, the U.S. dollar took over the role that gold had played under the gold standard, which is what gave "paper money" it's value. Now, rather than being backed by gold, the value of the world's money was to be determined by nothing more than the "perceived value" of the U.S. dollar based on a "promise" of the U.S. government, that it would back and redeem the currency in circulation when the demand was made.

Now if THAT isn't a counterfeiting and ponzi scheme rolled into one, I don't know what is. Citizens are put in jail for counterfeiting and ponzi schemes. At the Fed and government level, it's common practice and accepted as being "legal."

Are you KIDDING ME!!

I say "perceived value" because when the gold standard ceased to exist, there was nothing of Real Value to back it. Without the "belief in" the value of this "worthless paper money", the monetary system couldn't and wouldn't exist.

Combine that with how a fractional reserve banking system operates and it's clear to see how the world's wealth is being "legally stolen" through a very ingenious, yet sinister and serving plot to flat out STEAL the wealth of the many and redirect that wealth to a few.

Although it's become a globally accepted way of banking and doing business, and although it's "perceived as being LEGAL", essentially, it's nothing more than counterfeiting. Creating money out of thin air, charging interest to those who "borrow" this "money" that doesn't exist, creates even more money out of thin air, although NONE of it REALLY exists at all.

Add to that fleecing, an unconstitutional and out of control taxing system that

What it DOES do is keep entire cultures and societies enslaved within what can only be described as a cycle of slavery that requires savvy, understanding and a very specialized form of knowledge to break free from.

A kind and quality of knowledge that MOST in the world don't have which is precisely why so many "feel" and in fact are "money slaves."

Money is here to serve humanity, not vice versa.

When you make the choice to become aware, informed and educated about the monetary system and how to turn the tables, money can and will serve you, just as it was designed and intended to.

The obvious answer is gold. It has a 5000 year history of retaining it's value, hedging inflation and will always be a means to protect assets.

You can create a free gold account and earn money and gold by simply spreading the word to those who wish to protect their assets.

Who doesn't and/or wouldn't want to do that?

|

I'm Finished With The Bretton Woods Agreement

|

Below is EVERYTHING You'll Need to Put You Light Years Ahead of Most and Get You Headed in the Desired Direction...

|